The Role of a Semantic Layer

A semantic layer is a business representation of data that enables insurers to derive trusted insights using familiar terms like “policyholder,” “claim,” and “premium.” It provides a unified, consistent view of data across the organization, empowering both technical and non-technical users.

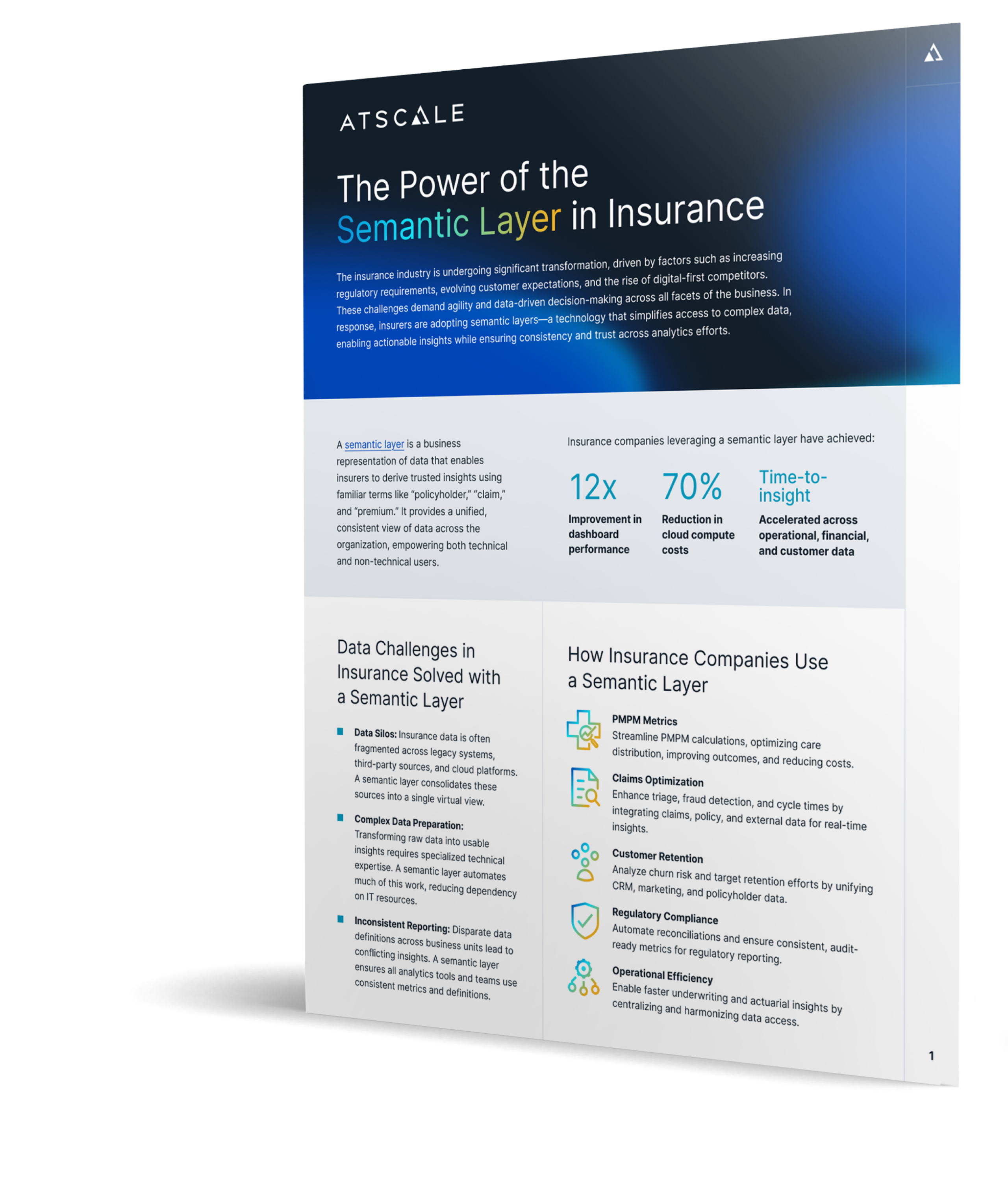

Insurance companies leveraging a semantic layer have achieved:

- 12x improvement in dashboard performance

- 70% reduction in cloud compute costs

- Accelerated time-to-insight across operational, financial, and customer data

How Insurance Companies Use a Semantic Layer

- PMPM Metrics: Streamline PMPM calculations, optimizing care distribution, improving outcomes, and reducing costs.

- Claims Optimization: Enhance triage, fraud detection, and cycle times by integrating claims, policy, and external data for real-time insights.

- Customer Retention: Analyze churn risk and target retention efforts by unifying CRM, marketing, and policyholder data.

- Regulatory Compliance: Automate reconciliations and ensure consistent, audit-ready metrics for regulatory reporting.

- Operational Efficiency: Enable faster underwriting and actuarial insights by centralizing and harmonizing data access.

The ROI of a Semantic Layer

- Reduced Cloud Costs: Semantic layers reduce cloud analytics expenses by optimizing query performance, minimizing data duplication, and streamlining data pipelines, resulting in up to a 70% reduction in compute costs.

- Faster Time-to-Insight: Semantic layers accelerate query speeds by over 10x, enabling faster decision-making across claims, underwriting, and customer service.

- Enhanced Data Governance: AtScale’s semantic layer ensures consistent metrics and secure access to sensitive data, providing robust governance for regulatory compliance.

- Operational Cost Savings: Insurance companies save millions in IT and analytics costs by reducing the effort required for analytics projects. For example, AtScale helped an online insurance marketplace democratize analytics and significantly accelerate reporting cycles.

Choosing the Right Semantic Layer Solution

When selecting a semantic layer solution, insurers should consider the following:

- Broad Compatibility: Support for cloud data platforms (e.g., Snowflake, Databricks, BigQuery) and BI tools (e.g., Tableau, Power BI, Excel, Looker) is essential to integrate seamlessly with existing systems.

- Scalability and Performance: Look for a solution capable of handling complex queries across massive datasets without compromising speed.

- Business-Friendly Interface: Ensure ease of use for non-technical users with intuitive tools and familiar business terms.

- Robust Security: Prioritize solutions that integrate with enterprise security frameworks and provide granular control over sensitive insurance data.